COLUMBUS, Ohio — Ohio lawmakers say they are trying to provide property tax relief by passing several targeted bills, but some homeowners say it's not enough — while public schools say it comes at their expense.

One of the main debates at the Ohio Statehouse this year has revolved around how to fix and reduce the skyrocketing property tax burdens.

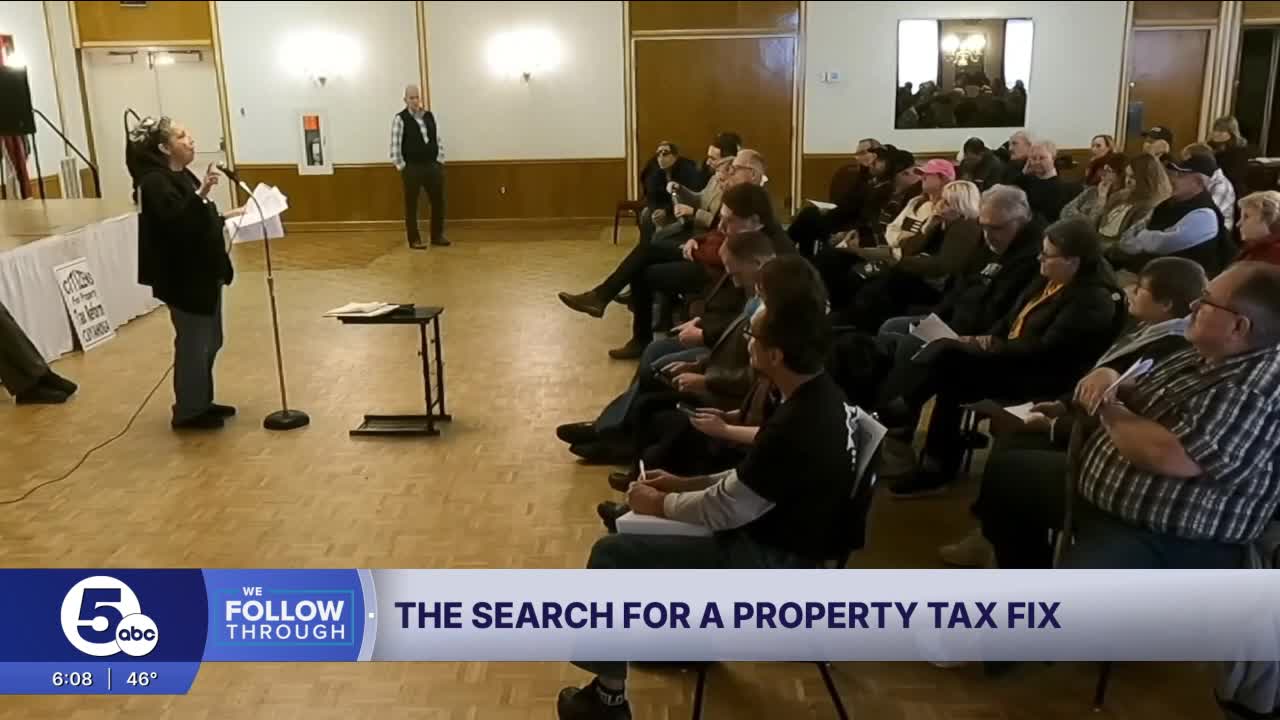

“People are suffering, they're losing their homes,” Lakewood resident Beth Blackmarr said.

But the legislature has to remember they need to support public schools, Parma Schools Superintendent Dr. Scott J. Hunt said.

“We continue to need operating dollars,” Hunt said.

Lawmakers passed four bills that Republicans say deal with the first issue, providing help for taxpayers.

"These are very, very important reform bills that are really the most consequential in almost half a century," state Rep. David Thomas (R-Jefferson) said.

House Bills 186 and 335 limit how much money school districts can get from rising home values — tying tax increases to inflation. These bills passed both chambers in a bipartisan fashion.

H.B. 309 allows county budget commissions to reduce property tax levies. It mainly passed along party lines, but a few Democrats joined the Republicans to pass it, while several members of the GOP voted no.

H.B. 129 implements a check on tax increases from school levies. In the House, it passed overwhelmingly, but in the Senate, all Democrats and state Sen. Bill Blessing (R-Colerain Township) voted no.

"We will no longer have huge increases in people's property tax bills if they did not vote for that," Thomas said.

RELATED: How big a difference will Ohio’s property tax proposals make?

Schools have been arguing for months now that these bills take away much-needed dollars for kids, when they are already facing cuts from the state in expected funding.

"We'll talk about [cutting] staffing, which impacts what programs we might consider to remain here at Parma and those that we might not be able to support," Hunt told me. "Certainly, those things impact the quality of education we can provide for our students."

The district will need to dramatically reduce its services if its levies continue to fail, he added.

RELATED: Northeast Ohio levies that failed mainly had 1 thing in common

"Everything will be on the table: transportation, potentially participation fees, we'll be looking at our buildings," Hunt said.

But Lakewood homeowner Beth Blackmarr, who is fighting to abolish property taxes altogether, said she doesn’t want to hurt the schools. Lawmakers aren’t doing enough to actually provide relief, she said.

RELATED: Ohio group seeking to abolish property taxes says it has collected well over 100,000 signatures

"They knew they were supposed to do something," Blackmarr said. "They ignored it in favor of pet projects like the Browns stadium."

Instead of spending months focusing on how to use unclaimed funds to move the Browns to Brook Park, she said, affordability should have been the legislature’s focus.

Thomas said it has been his priority, and he plans to continue that.

"It is not enough," Thomas said. "We need to do much more."

It’s unclear how much money this legislation would actually save taxpayers like Blackmarr. But she said one thing is clear — these bills needed to pass years ago to actually impact her bills.

"This is a huge problem, and, by the way, a problem of the legislation's own making," Blackmarr said.

Follow WEWS statehouse reporter Morgan Trau on Twitter and Facebook.