COLUMBUS, Ohio — Ohio Gov. Mike DeWine signed several bills meant to provide property tax relief into law, but anti-property tax advocates aren't impressed, and they are moving forward with their efforts to abolish them altogether.

'They're gonna price me out of my home'

Once his dream home, Brian Massie said after 20 years, it’s turned into a nightmare.

"I saw that the property taxes had gone up 40%," Massie said.

The Concord Township homeowner has been frustrated with bills, ones he never thought in his nearly 80 years of life would get so high over the past two decades.

"If we stay on this path of ever-increasing property taxes, they're gonna price me out of my home," he said.

State lawmakers say they know it's a problem, which is why they are cheering some brand-new laws.

Ohio Gov. Mike DeWine has signed a slew of bills aiming to relieve property tax burdens.

DeWine says he wants to, "Fairly achieve property tax relief and at the same time, protect our schools, our police, our fire, and our essential other services.

House Bills 186 and 335 limit how much money school districts can get from rising home values — tying tax increases to inflation. These bills passed both chambers in a bipartisan fashion.

H.B. 309 allows county budget commissions to reduce property tax levies. It mainly passed along party lines, but a few Democrats joined the Republicans to pass it, while several members of the GOP voted no.

H.B. 129 implements a check on tax increases from school levies.

H.B. 124 gives county auditors greater oversight in using property tax sales information for determining property valuations.

RELATED: How big a difference will Ohio’s property tax proposals make?

"Property taxes in Ohio will be more understandable, and they'll be more predictable for those taxpayers who pay property taxes," said Pat Tiberi, the chair of the governor's property tax working group.

But Massie isn’t impressed.

"Too little, too late," he said. "If they can't do anything for the seniors, that was sort of the straw that, as they say, broke the camel's back."

Ballot proposal

I asked Massie if he felt that Ohioans needed to take matters into their own hands because their representatives aren't listening.

"That was basically our thought," he said.

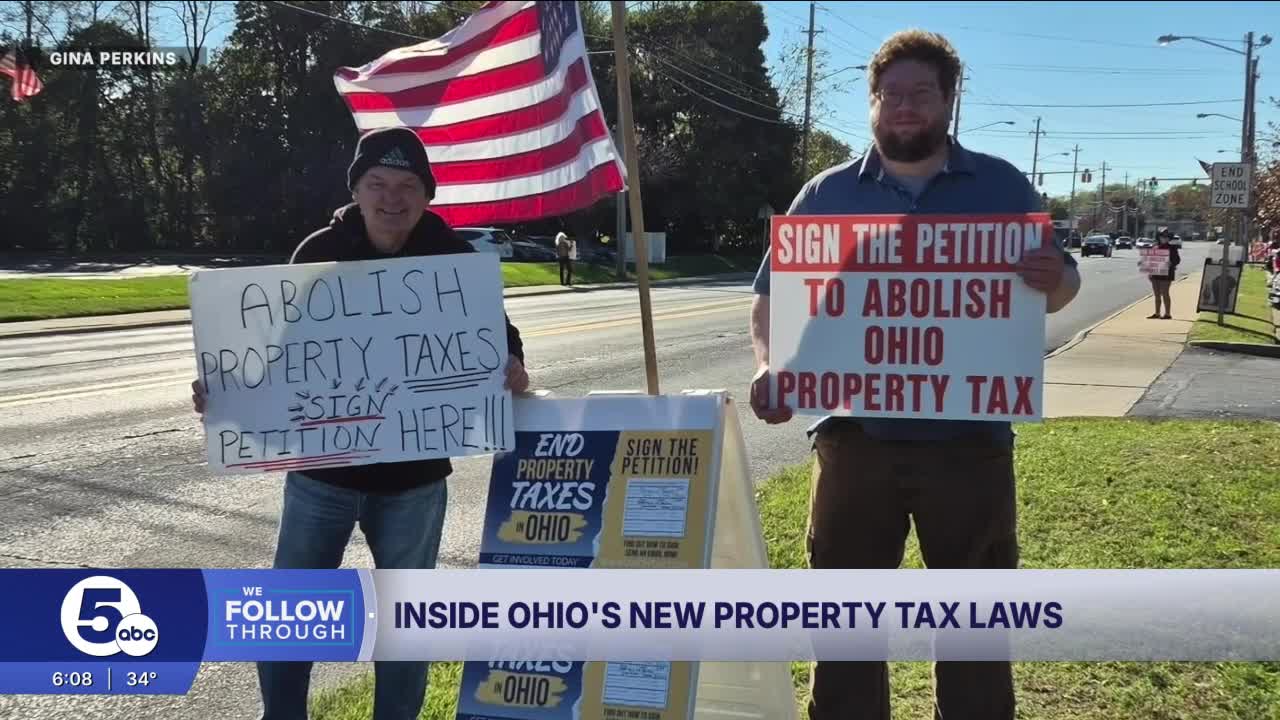

Massie is a part of the Committee to Abolish Ohio Property Taxes, currently collecting signatures to get a constitutional amendment on the ballot. Advocates from Citizens for Property Tax Reform, another group with the same mission, said it has collected more than 100,000 signatures already.

Lawmakers are worried, which accounts for the sudden action after years of letting taxes grow.

"I have to say that the threat of a ballot initiative is part of the thing that's driving this," House Speaker Matt Huffman (R-Lima) said.

Those efforts are not good enough, some Ohioans have told News 5 and testified at the statehouse over the last year.

"These bills that were just signed into law, are they enough to gain your support?" I asked Massie.

"No, absolutely not," he said.

The groups are trying to get the amendment on the November 2026 ballot.

The Committee to Abolish Ohio Property Taxes has already gotten signatures from the required 44 of 88 counties needed and has hundreds of petitioners deployed across the state, Massie said. It needs about 415,000 valid signatures and is aiming to submit about 620,000.

Education

Schools have been arguing for months now that these bills take away much-needed dollars for kids when they are already facing cuts from the state in expected funding.

"We'll talk about [cutting] staffing, which impacts what programs we might consider to remain here at Parma and those that we might not be able to support," Parma Schools Superintendent Dr. Scott J. Hunt told News 5. "Certainly, those things impact the quality of education we can provide for our students."

While Massie said that schools just need to be more responsible with their money, the leaders of Citizens for Property Tax Reform have a more sympathetic outlook. Organizer Beth Blackmarr said that lawmakers have spent hundreds of millions on a stadium for the Cleveland Browns, rather than fairly funding schools or focusing on property taxes.

This summer, state lawmakers gave the Browns a $600 million performance grant for their new Brook Park stadium using unclaimed funds. Ohio's Division of Unclaimed Funds currently oversees about $4.9 billion in funds, including forgotten bank accounts, utility deposits, uncashed checks and more.

Blackmarr said that the time spent finagling this proposal would have been better spent on problems that citizens are facing.

Districts worry that the ballot proposal will render public schools obsolete.

RELATED: Why schools and homeowners are frustrated by Ohio's property tax bills

Follow WEWS statehouse reporter Morgan Trau on Twitter and Facebook.