COLUMBUS, Ohio — A Mastercard being mailed out to FirstEnergy customers raised red flags for consumers. News 5 dove in to see if it was real or a scam.

This is the second fact-checking story News 5 has done on FirstEnergy payments.

About the settlement

Many Northern Ohioans were included in a nearly $50 million settlement from FirstEnergy and Energy Harbor, FirstEnergy's former spin-off. This also included FirstEnergy-owned companies like Cleveland Electric, Ohio Edison and Toledo Edison. Consumers sued the companies because FirstEnergy bribed lawmakers to pass a law benefiting them, which increased the price of their services.

This June, former House Speaker Larry Householder got 20 years in prison for his role in the state’s largest bribery scheme. He accepted a $61 million bribe from FirstEnergy and other utilities in exchange for a $1.3 billion bailout to help their struggling nuclear power plants.

Fact-checking

FirstEnergy's bribery scandal settlement payments are mainly coming from a "sketchy" but legitimate email link. At the beginning of August, News 5 verified that the digital card was real.

Once News 5 aired this story, the official website of the class action settlement updated its site to inform consumers of the payment method.

Then Thursday, News 5 shared that customers were having trouble accessing the money.

After that report, FirstEnergy customer Michael Hernandez reached out with another concern.

"There are so many scams out there you don't know what to believe," Hernandez said. "That's why I got a hold of you guys and wondered, is this a scam?"

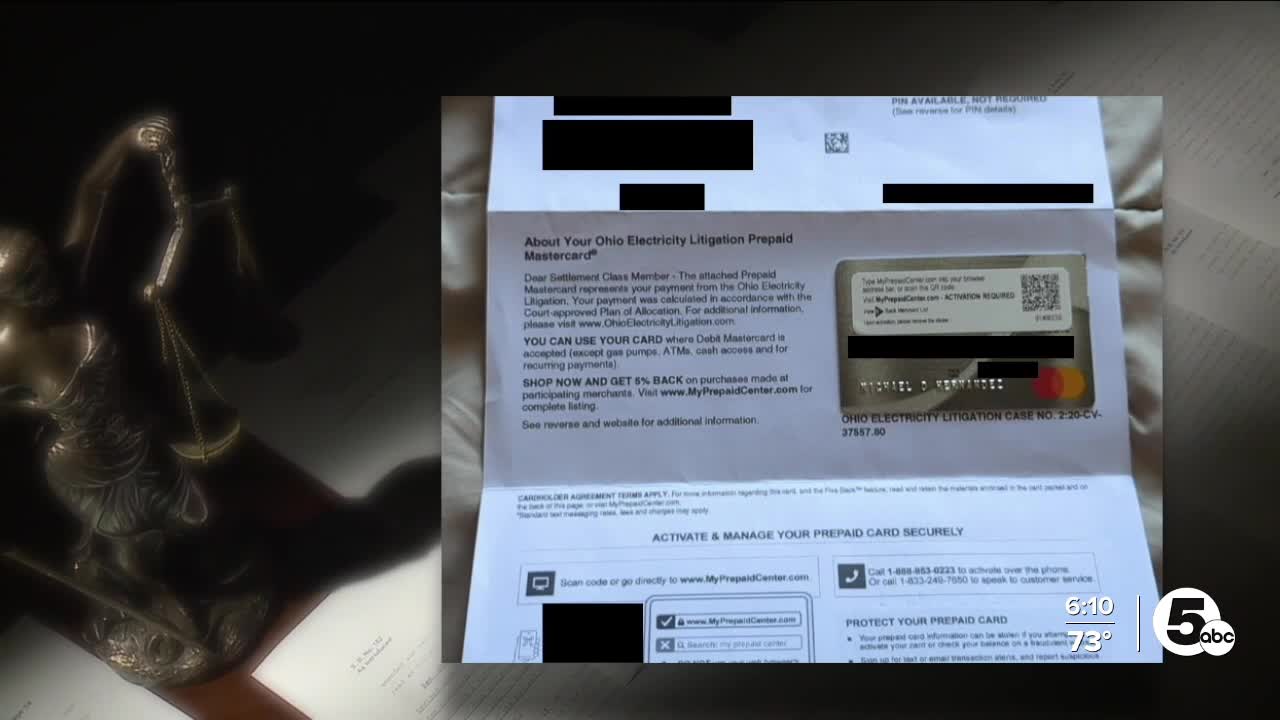

He didn't receive the email that News 5 previously reported on but was sent a letter. It had a Mastercard with it and explained briefly about the settlement.

"It's different than the usual one that comes in the mail when I get my credit card or my debit card," he said.

Case Western Reserve University consumer protection law professor Cathy Lesser Mansfield explained anything that seems "off" should make the consumer pause.

"You have to be very careful," Lesser Mansfield said. "The scams are so sophisticated these days that you sometimes can't know what's a scam and what isn't."

The red flags were raised for Hernandez.

"The letter said nothing about any amount of money," he said.

Not having the settlement amount made the letter seem suspicious and not personalized to him.

So, is it real?

Yes.

One of the attorneys from the lawsuit confirmed to News 5 that it is legit.

If FirstEnergy did not have an email address for a customer's account, they mailed the card instead.

The vendor was supposed to put the dollar amount on the letter but forgot to, the attorney added. The cards were then mailed before a claims administrator caught the error.

"They definitely should have done this a different way," Hernandez said. "They should have put it in your bill."

The attorney in the lawsuit agreed — and actually tried to push for that. However, FirstEnergy fought adamantly against putting the money back through utility bills.

This would require tedious steps through the Public Utilities Commission of Ohio, according to the attorney.

How much did Hernandez get? Under $8. The average amount is just $15.

"What a crock; $7.80," Hernandez said. "Government, Edison and Harbor win again."

Accessing money

News 5 reported Thursday that some ratepayers feel they are being victimized twice due to how difficult it is to use the money.

If a customer received a physical card, they are in a much better position to use their money than if they received a digital one.

Digital

- Money can only be used for online purchases

- Unable to deposit the money into a bank account or cash apps like Venmo

- Cannot get cash from it

- Can be added to a digital wallet like Apple Pay

- After having the card for one year, the company has a monthly inactivity fee of $3.95.

Physical

- Money can be used online or in person, with exceptions

- Exceptions: ATM, gas pumps, cash access and for recurring payments

- After having the card for one year, the company has a monthly inactivity fee of $5.95.

If a customer is getting more than $250.00 from the settlement, they will be mailed a check.

Click here for a thorough PDF on how to access your money.

Follow WEWS statehouse reporter Morgan Trau on Twitter and Facebook.