CLEVELAND — Amber Jascob says grocery shopping has gotten more difficult.

“When I spend $200 and only walk in the house with four or five bags, it’s defeating,” she said.

She and her husband work full-time, but with prices climbing, Jascob has cut back on big trips and instead shops in smaller batches to be able to afford them.

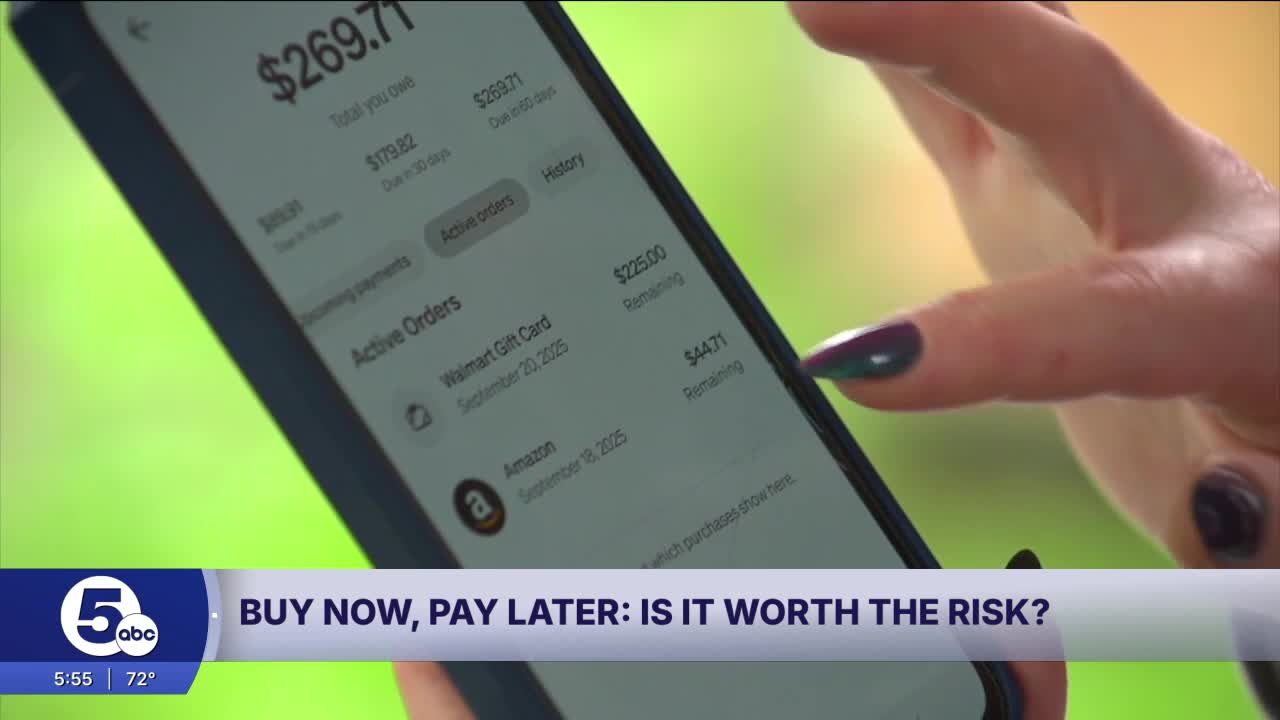

That changed when she turned to Afterpay, a buy now, pay later service that lets shoppers split purchases into installments that are interest-free.

Other similar services include Klarna and Affirm.

Once mostly used for clothing, the option is becoming more popular for groceries.

In 2014, LendingTree reported that just 14% of users were paying for groceries this way. Their latest numbers show that figure has grown to 25%.

Jascob recently bought a $300 Walmart gift card through Afterpay, paying only $75 upfront.

“Paid for it with the Afterpay. And then I was able to take the gift card numbers and add it to my Walmart account. And I was able to scan and I paid for my groceries with the $300 gift card,” she said.

She now pays off the balance every other week.

“People are looking for things that can do to extend their budget and make ends meet a bit easier,” said Matt Schulz, chief consumer finance analyst at LendingTree.

Schulz warns that while these loans can be interest-free if paid on time, late payments can come with fees and interest rates as high as 36.99%.

For Jascob, the trade-off has been worth it. She said the service has helped her afford bigger grocery trips and stock up her freezer.

What to know before trying "buy now, pay later" for your groceries:

- Budget carefully. These services can make a big bill feel smaller, but the payments still add up.

- Stay on schedule. Most plans are interest-free only if you pay on time. Miss a payment, and fees kick in.

- Watch for high penalties. Late fees and interest rates can climb as high as 36.99%.

- Track multiple orders. It’s easy to lose track of payments when you’re juggling several active purchases.

- Don’t rely on it long-term. Experts warn BNPL should be a short-term tool, not a substitute for building a stable budget.

Each week, we’ll visit Meijer, Giant Eagle, Aldi, Walmart, Heinen's and Dave's Market, checking prices on everyday essentials.

Those include: 2% milk, a loaf of wheat bread, chicken price per pound, ground beef tray or patty per pound (80% lean 20% fat), 12 dozen white eggs, and toasted oats cereal.

If you're willing to shop around, you can snag even deeper discounts on meat, dairy, and pantry goods.

We’re also giving you a chance to see how your favorite stores stack up week to week. We’ll compare how grocery prices change at each store on a weekly basis.

Here's how prices compare across stores this week:

Meijer

Giant Eagle

Aldi

Walmart

Heinen’s

Dave's Market

From buy-one-get-one-free meat deals to cereal under $2, our Don’t Waste Your Money team will be keeping an eye on store shelves and sharing what we find.

Find a better deal? We want to hear from you! Submit your finds through the form below. If you beat our prices, we’ll feature them.

And if you’re a savvy shopper, always chasing the best deals, we may even join you on your next grocery run.