COLUMBUS, Ohio — As Gov. Mike DeWine warns that Ohio's sales tax would need to go up to 20% if a proposal to abolish property taxes passes this November, campaign organizers argue that it isn't their problem.

Rising property taxes have reached a breaking point for many Ohioans.

"The ever-increasing property taxes truly are pricing people out of their homes," Brian Massie, who lives in Concord Township, said.

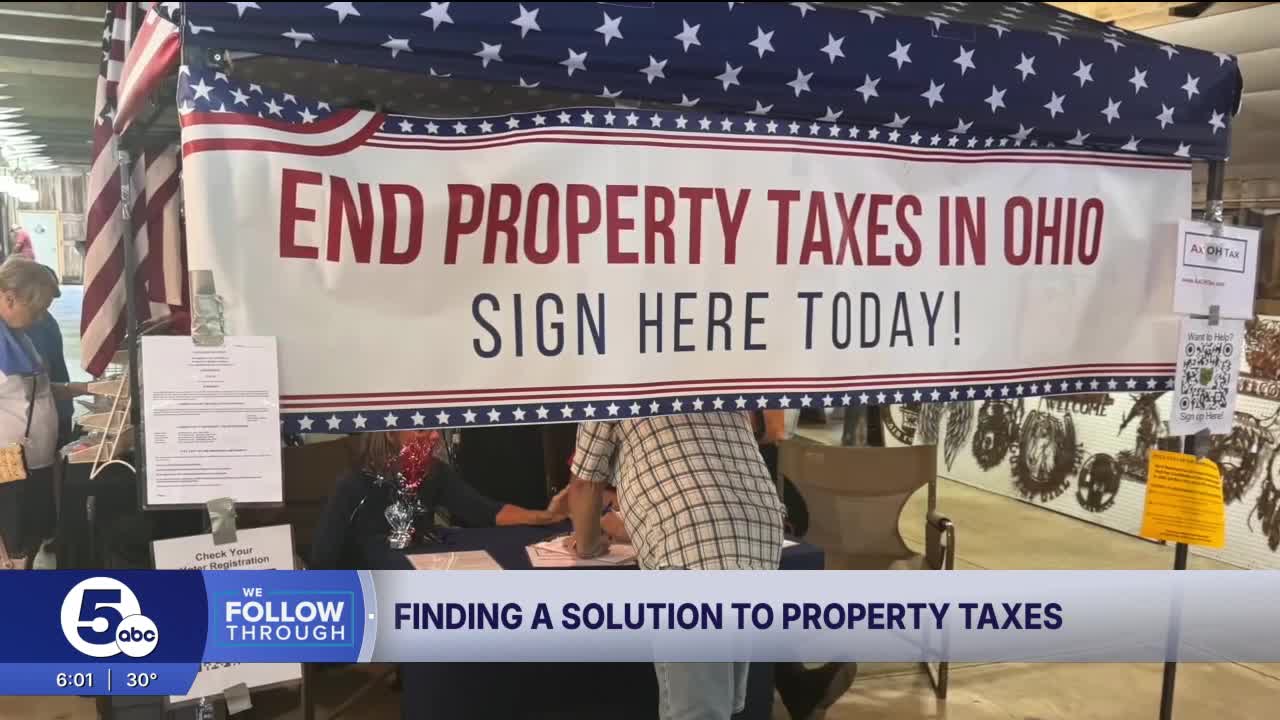

Massie is helping lead the charge to bring down bills. He is part of the Committee to Abolish Ohio Property Taxes, which is currently collecting signatures to get a constitutional amendment on the ballot.

"The people in the state of Ohio have had enough," he said. "They want their freedom and liberty, and I don't know why these legislators don't understand that."

The campaign is trying to get the amendment on the November 2026 ballot. It needs about 415,000 valid signatures and is aiming to submit about 620,000.

Both Democratic and Republican politicians, like DeWine, say it could cause a major funding hole for essential services.

"It would just be devastating to all kinds of local government, starting with schools, but also police and fire and children's services," DeWine said Thursday.

Geauga County is currently working to raise awareness of the problems it could cause them.

Nonpartisan research group Policy Matters Ohio found a myriad of concerns with the proposal, linking to conservative think tank Tax Foundation's study. The report said that if the proposal passes, Ohio would have to make up more than $20 billion in one year.

"The sales tax would go up to 17, 18, 19%, 20% sales tax in the state of Ohio on products that you buy," the governor said. "It would just be absolutely devastating."

Zach Schiller with Policy Matters explained that sales tax rates differ per county, but the base rate is 5.75%.

On a $100 purchase, there would be about $6 in sales tax. But if the amendment is successful, sales tax could be an additional $20 on that same purchase.

"If you raise the sales tax, it especially hurts poor people," Schiller said.

Some Ohioans say they aren't concerned by the sales tax increase, since buying products isn’t mandatory. Massie added that there are other ways to make up that money.

"They need to cut the size of government," he said. "They need to rein in the spending for these public schools."

Cutting the government, to Massie, could mean getting rid of county auditors and treasurers, he said.

Schiller said that this was entirely unrealistic. There is no possible way to make up $20 billion from eliminating 176 jobs, not to mention that they are needed for more than just reviews of property taxes, he said.

RELATED: Why schools and homeowners are frustrated by Ohio's property tax bills

"The idea that there's some giant bloated amount of government out there that we can simply trim, and as a result, pay less in taxes, is a wildly excessive kind of notion," Schiller said. I think that they should put their money where their mouth is. Give us the actual facts. Don't just make general statements about, 'Oh well, we can save by cutting government, ' give us specifics."

He also pushed back on the assertion that schools are recklessly spending.

"The bulk of property tax goes to schools, and 80% or more of school revenue goes to pay teachers and other line staff," he added. "You want to get rid of teachers, get rid of the property taxes."

Massie said that it isn't the campaign's problem to figure out how to make up the money.

"They expect me and our group to have an answer on how we're going to replace all of these property taxes," he said, incredulously. "The state legislators, it is incumbent upon them, to go back to the drawing board," he said.

Maybe if the lawmakers didn't use taxpayer dollars to fund their pet projects, like the Cleveland Browns stadium, Massie said, the state would be in a better position.

Another way to make up the money would be to drastically increase the state income tax. For years, Republicans have been eliminating tax brackets and helping the wealthiest Ohioans.

They have no interest in increasing the income tax, several GOP legislators told us.

Follow WEWS statehouse reporter Morgan Trau on Twitter and Facebook.