CUYAHOGA COUNTY, Ohio — The Cuyahoga County Treasurer’s Office, along with the Board of Revision, is helping people get on track with their tax bills and understand the process for challenging their current property valuation.

“This is an opportunity for our residents, if they don’t agree with the valuation of their property, to formally complain about it,” said Cuyahoga County Fiscal Officer Michael Chambers.

During the first of five outreach sessions in Cuyahoga County, the Board of Revision met with property owners like Linda Martin, who said she’s experiencing some challenges with her two Cleveland properties.

“I wanted to make sure I was here, so I could find out what was going on,” said Martin. “The houses that I have they’re not up to par with the property value that they say.”

Martin said she’s trying to get her property value down because she’s on a fixed income and doesn’t want to lose the home her mom left her after she died nine years ago.

“The last person I had in there; they messed the house up so bad, so now I’m just trying to get the property value down because it’s a lot of work that has to be done in that house over there,” said Martin.

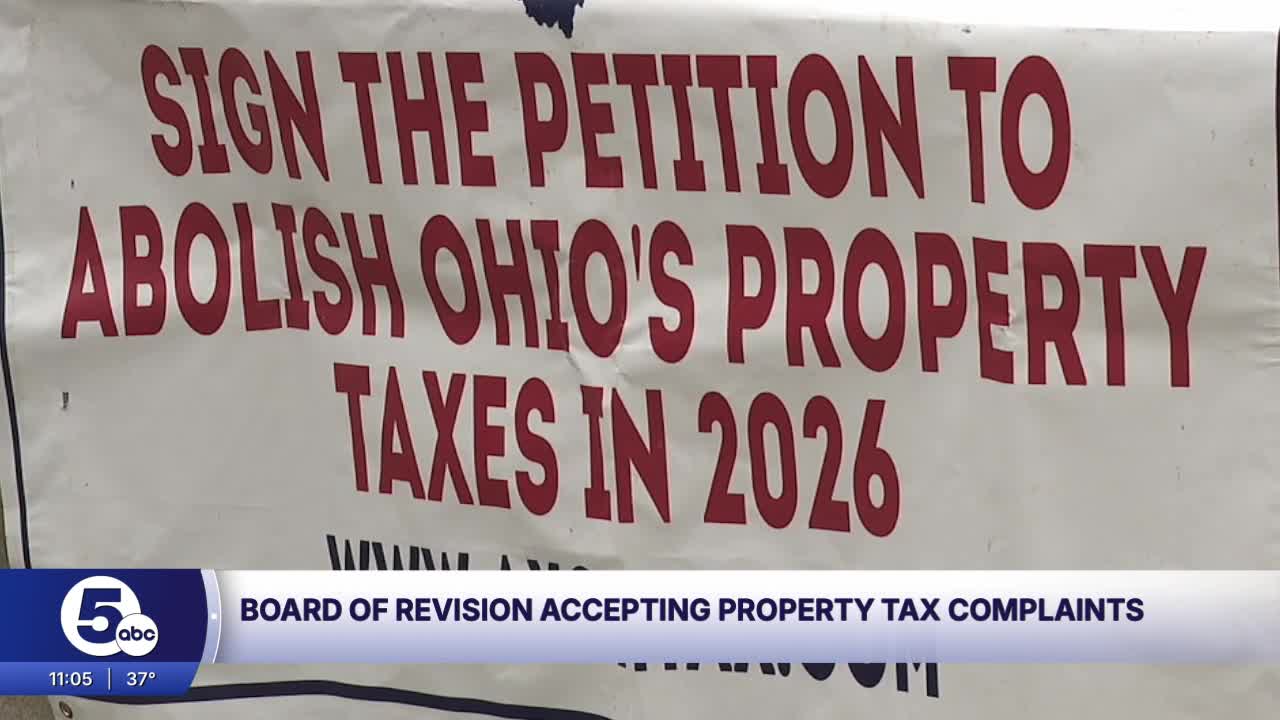

Meantime, Micah Zakem, with Citizens for Property Tax Reform, stood outside Saturday’s first community outreach session to call for Ohio’s property taxes to be abolished in 2026.

“We’re happy to pay our share of taxes, but in Ohio, our taxes have gone up so much that we have a number of people that are losing their homes,” said Zakem.

Now, the Ohio group is asking people to sign their statewide petition, so they can reach their goal of 600,000 signatures and get this issue on November’s ballot.

“I feel like I’m being pressed out of my house. I don’t even feel like I even own my house anymore, so it’s like I had to do something,” said Gino Pirozzoli.

“Taxes is a byproduct. This is all about valuation,” said Chambers. “Some people may not have gotten the opportunity last year to file and we had the big increases, so this is their next opportunity to file if they don’t believe their value of the property is the same value.”

Chambers said you can only appeal every three years, so if you have yet to file a property valuation complaint in the last several years, he said you have until March 31.

“It’s our job to get out there and let people know if they still don’t agree with their value, here’s what you need to do,” said Chambers.

To join one of the next four sessions, click here.